ADOT

Maricopa’s 347 Tax Approved: Community Backs New Measure!

On May 6, 2025, a significant public hearing took place regarding the Commuting Corridors Sales Tax Fund at Maricopa City Hall. The hearing attracted a large turnout, with all seats filled as community members voiced their opinions. A pivotal decision emerged: Maricopans will now pay an additional penny for every $2 spent on most goods and services.

The Maricopa City Council unanimously approved a half-cent sales tax aimed at funding vital local transportation projects, including improvements to State Route 347. Mayor Nancy Smith emphasized the urgency of the matter, stating, “The ability to fund expansions of roads is shrinking every single year. This is a problem because we are growing at such a fast rate.” She branded the meeting as the most important of her tenure.

Vice Mayor Henry Wade expressed his full support, declaring, “I’m all in on this.” Councilmember Eric Goettl, initially reluctant about the tax, shared mixed emotions but ultimately agreed, acknowledging the flaws in the current funding system. He remarked, “Infrastructure requires funding and that’s why we’re here this evening.”

While Councilmember Vincent Manfredi has historically opposed tax increases, he recognized the necessity of the measure. “A sales tax increase of just half a cent is a small price for needed infrastructure and peace of mind,” he noted.

The newly established Commuting Corridors Sales Tax Fund will elevate the municipal tax from 2% to 2.5%, applicable to restaurant dining and non-food retail sales beginning October 1, 2025. Construction and contracting services will also see an increase, raising taxes from 3.5% to 4%. This measure is expected to generate approximately 40% of the tax revenue.

Notably, essential items like lodging, groceries, and gasoline are exempt from this tax. The city anticipates earning around $5 million in the next fiscal year, with projections of at least $8 million annually until the tax expires in October 2045.

Revenue collected from this tax will be managed by the Arizona Department of Revenue and allocated to the city’s general fund for infrastructure projects. Initial focus will be on State Route 347, with potential future investments in State Route 238 and other critical routes.

Recognizing the importance of this funding, the city has already included it in the preliminary 2026 budget. An intergovernmental agreement with the Arizona Department of Transportation will allow Maricopa to contribute $50 million upfront for road widening in exchange for reimbursement through this tax fund. Current estimates for the highway improvement are around $135 million.

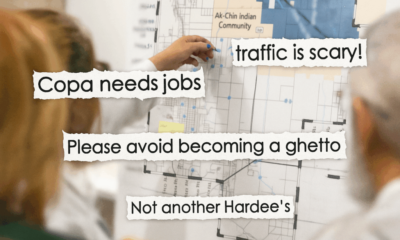

Community feedback indicates ongoing support for investment in local infrastructure. Recent polls show 64% approval for the tax among surveyed residents. However, some opposition remains, particularly vocally on social media. Despite this, participants in the public hearing expressed overwhelming support, highlighting personal stories connected to State Route 347.

Ryan Tafoya, a Central Arizona College student, poignantly remarked, “I’ve laid flowers on the tributes to these people on the 347 for many years… I hope that the result of the vote today means that, going forward throughout my life, I can give more flowers and celebration rather than mourning.”

As Maricopa embarks on this new fiscal chapter, residents’ voices underline the community’s commitment to enhancing local infrastructure and safety.