Business

Tech Tariffs in Limbo: Brace for Price Increases, Experts Warn

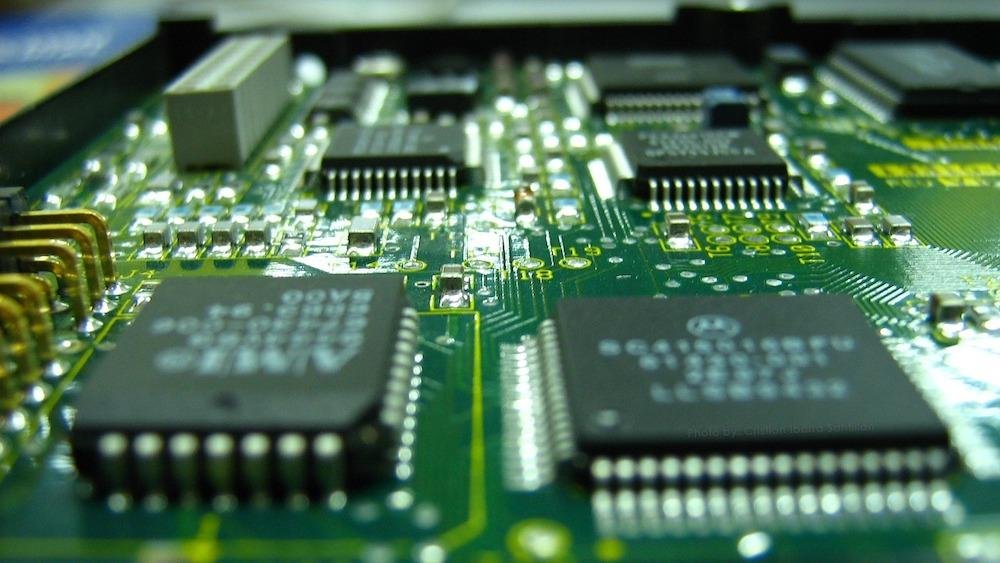

Experts predict a rise in technology goods and services prices in the U.S. in the coming months due to shifting tariff strategies for imported electronic hardware by the White House. Initial reports suggested tariffs as high as 145% on Chinese imports, but a recent announcement by President Trump clarified that electronics such as smartphones and computers would be exempt, while indicating that semiconductors could soon face their own tariff structure.

In a move coinciding with Trump’s announcements, the U.S. Department of Commerce launched an investigation into semiconductor imports. The inquiry will assess national security implications related to importing manufacturing equipment and its derivatives. Analysts interpret this dual approach as a means to both pressure American manufacturers to increase domestic production and identify cybersecurity risks linked to foreign manufacturing.

Derek Lemke, a senior vice president at risk management firm Exiger, emphasized the critical nature of semiconductors, stating, “They power everything from advanced weapons systems and critical infrastructure to smartphones and laptops.” Many of these components, however, are produced in regions with geopolitical tensions and questionable supply chain transparency.

The U.S. is ramping up semiconductor production, accounting for about 10% of global output in 2022, with projections to reach 14% by 2032, partly due to the CHIPS and Science Act passed during Biden’s administration. While American firms design advanced chips, they are predominantly manufactured in Taiwan, which is currently negotiating tariff agreements with the U.S.

Manufacturing processes for electronics are complex and span the globe, complicating tariff implementations. Nikolas Guggenberger, an assistant professor at The University of Houston Law Center, noted that while increasing domestic semiconductor manufacturing could mitigate reliance on foreign sources, the U.S. lacks the infrastructure and investment to meet its needs immediately. He described semiconductor manufacturing as “among the most complex industrial processes on Earth.”

As the U.S. seeks clarity on tariffs and the outcome of its semiconductor investigation, Guggenberger and Lemke warn consumers to brace for higher prices on essential electronics. Semiconductors are integral to a multitude of products, meaning price increases could impact broader consumer spending.

“From a computer to everyday devices, like a garage opener or a toaster, it’s absolutely everything,” Guggenberger said. The potential for high tariffs could also lead to manufacturing slowdowns, resulting in emptier store shelves and product backlogs in the near future.

The software sector is also poised to feel the ramifications. Lemke pointed out that software developers, AI innovators, and cybersecurity firms depend significantly on chip hardware, and disruptions in the supply chain could hinder progress across these fields. The mere discussion of tariffs has already created ripples throughout the tech industry, compelling companies to reevaluate their supply chains and possibly stockpile key components.

“The uncertainty alone is enough to influence pricing, procurement strategies, and investment decisions across the tech ecosystem,” Lemke remarked.