Business

Tax-And-Spend States Still Ignoring Lessons That Could Save Them

By Dr. Thomas Patterson |

Our federal system epitomizes the laboratory of democracy, allowing states to learn from each other’s policies such as charter schools and taxation levels. However, some states remain slow learners.

The IRS’s recent annual report on net migration reveals high-tax states as the biggest losers. California topped the list with a net loss of $23.8 billion in 2022, followed by New York at $14.2 billion, and Illinois at $9.8 billion. Losses continued with New Jersey ($5.3 billion) and Massachusetts ($3.9 billion).

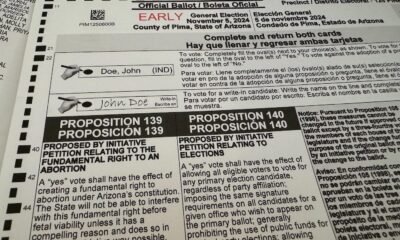

Conversely, Florida gained $36 billion in migrated revenues. Texas followed with $10.1 billion. Other states, like South Carolina, Tennessee, and North Carolina, also saw gains. Arizona benefited too, gaining $3.7 billion in gross adjusted income (AGI), primarily due to 57,857 people moving from California while only 25,677 left Arizona for California.

Basic necessities like affordable housing, reliable power, and effective law enforcement seem to attract people. California fails on these fronts. Fuel costs $1 to $2 more per gallon, and electricity bills are two to three times higher than in states without California’s strict climate mandates.

With a median home price nearly double the national average and a 9.3% tax rate on middle-income earners, California is driving its residents away. Governor Gavin Newsom’s talk of the “California Dream” falls flat as residents leave if they have the means.

The trend is worsening. In 2022, California’s income loss to other states nearly tripled compared to 2019. New York faced similar issues, losing 1.8% of its total state AGI in 2020, 3.1% in 2021, and 2.5% in 2022 despite high housing costs.

Florida and Texas have benefited, seeing a 150-200% increase in income from high-tax states since the pandemic began.

States like California, New York, and Illinois have created a “doom loop” with poor fiscal policies. Fewer workers and lower income levels mean reduced tax revenues, prompting these states to raise tax rates to support social programs and manage debt. This cycle perpetuates itself.

In contrast to standard business practices, high-tax states resist updating their fiscal models. California continues with ambitious climate mandates and projects like the expensive, uncompleted “train to nowhere.” Illinois opted for a budget including $1.1 billion in tax increases. New Jersey reimposed a 2.5% corporate surtax despite job losses.

These states avoid modest reforms and spending cuts, instead pushing other states to offset their high taxes. They support removing the $10,000 cap on the state and local tax (SALT) deduction, which otherwise saves about $80 billion a year for federal taxpayers.

According to the Brookings Institution, eliminating the SALT cap would predominantly benefit the top 1% of earners. Despite this, high-tax proponents argue that the cap has exacerbated their financial problems.

Mismanagement of pension fund obligations further complicates matters. Raising benefits is popular while funding is often postponed, leading to chronic underfunding. New York and New Jersey can only cover 48% and 29% of future obligations, respectively.

This shortfall may lead to public bankruptcies and financial insecurity for retirees. Yet states resist necessary reforms, assuming federal assistance in dire circumstances.

States must be accountable for their decisions and should not rely on exploiting others to rectify their fiscal and moral failures.

Dr. Thomas Patterson, former Chairman of the Goldwater Institute, is a retired emergency physician. He served as an Arizona State senator for 10 years in the 1990s and was the Majority Leader from 1993 to 1996. He authored Arizona’s original charter schools bill.