Education

Commissioner Reveals: Retirees Funded Our Schools Long Before Graduation

Maricopa, a burgeoning city equipped with unique challenges, is embracing the future as it seeks solutions for its growing population. Transportation issues continue to be a hot topic, as residents navigate the effects of rapid development. Despite the hurdles, the city has managed to lower primary and secondary property tax rates for six consecutive years while simultaneously expanding its infrastructure.

A significant result of this growth is the addition of 500 to 750 students annually in local schools, necessitating the construction of at least one new school every two years. However, funding for school facilities took a hit during the Great Recession when the Arizona School Facilities Funding Formula was overhauled, drastically reducing available resources for districts. Unfortunately, this gap in funding has never been addressed, forcing districts to seek local resources to maintain operations and maintenance.

Bond propositions have long been a strategy for financing local projects, and the Maricopa Unified School District (MUSD) has successfully utilized bond funding to meet its needs. As the population continues to swell, MUSD has adhered to sound financial practices, ensuring that bonds are repaid promptly without overwhelming taxpayers with multiple concurrent bonds. This thoughtful approach could even lead to a decrease in the bond rate or an early payoff as the city grows.

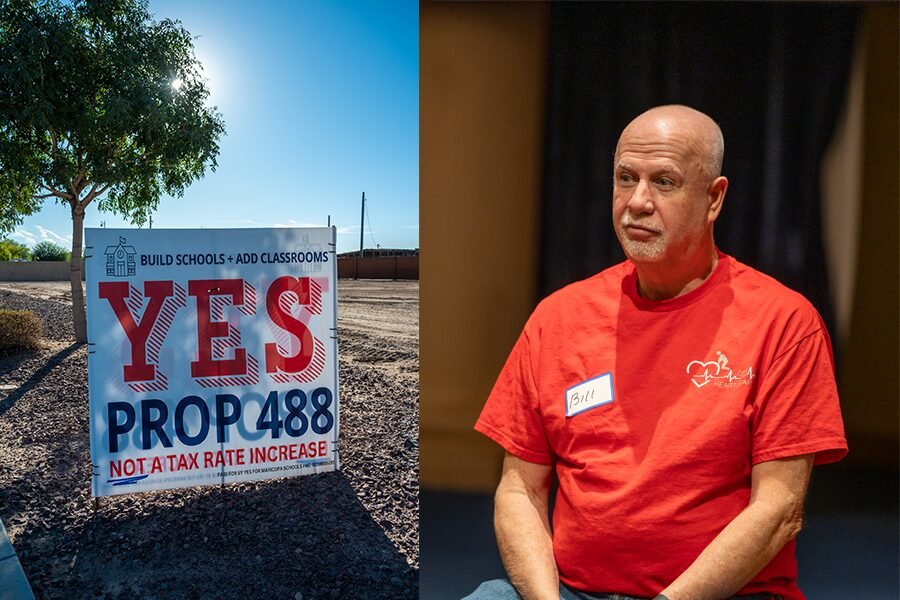

Without the proposed bond, essential expansion plans and operational budgets could face severe reductions, risking the loss of vital programs like trades and workforce training, while potentially increasing class sizes and introducing split-session schedules. Despite his personal ties to the district being limited, Bill Robertson, a retired Maricopa citizen, emphasizes the importance of supporting future generations. He points out that retired individuals also contributed to school taxes during their time, creating a shared responsibility for the current challenges.

Robertson stresses that passing Proposition 488 will not introduce a new tax but will maintain the existing rate. This new bond, designed for specific projects, differs from a general property tax that could persist indefinitely. A citizens’ oversight committee will be established to ensure transparency in project funding and expenditures.

This initiative presents a dual opportunity: advancing infrastructure without increasing tax obligations. Robertson advocates for community support, urging residents to recognize the pressing needs of their schools and to vote yes on Proposition 488.

Bill Robertson, Province

Member, Maricopa Planning & Zoning Commission