arizona

Tech Startup Empowers Individuals in Debt: Affordable Legal Assistance for Collection Lawsuits

Debt collectors initiate millions of lawsuits against American adults annually, often winning by default due to a lack of response from defendants. A new tech startup aims to simplify the process of responding to these legal actions, potentially changing the outcome for many.

Recent research by the Debt Collection Lab reveals that nearly one in four American adults have experienced a debt being referred to private collectors. Major collection agencies file millions of lawsuits each year, particularly focusing on smaller debts typically below $10,000. For many, these amounts are significant enough to cause severe financial strain but not large enough to warrant legal representation.

Anne Munoz from northern Arizona exemplifies the struggle many face. After being sued over a debt she asserted was unjust, Munoz took on her case without legal assistance. “I can’t afford a lawyer,” she remarked, highlighting the challenge of navigating the legal system without support. After dedicating numerous hours researching her situation, Munoz successfully had her case dismissed by a judge.

Unfortunately, most consumers do not respond when served with lawsuits, which frequently results in default judgments favoring the debt collectors. Lester Bird from the Pew Charitable Trusts estimates that between 60% and 70% of such cases result in automatic wins for collectors, as many individuals lack the knowledge or resources to contest these lawsuits.

George Simons, founder of the tech company Solo, recognizes this problem and aims to provide a solution by simplifying the legal response process for individuals. His motivation stemmed from his own difficulties in finding legal representation during law school. “If I couldn’t find a lawyer in a building full of them, how are others managing?” he pondered.

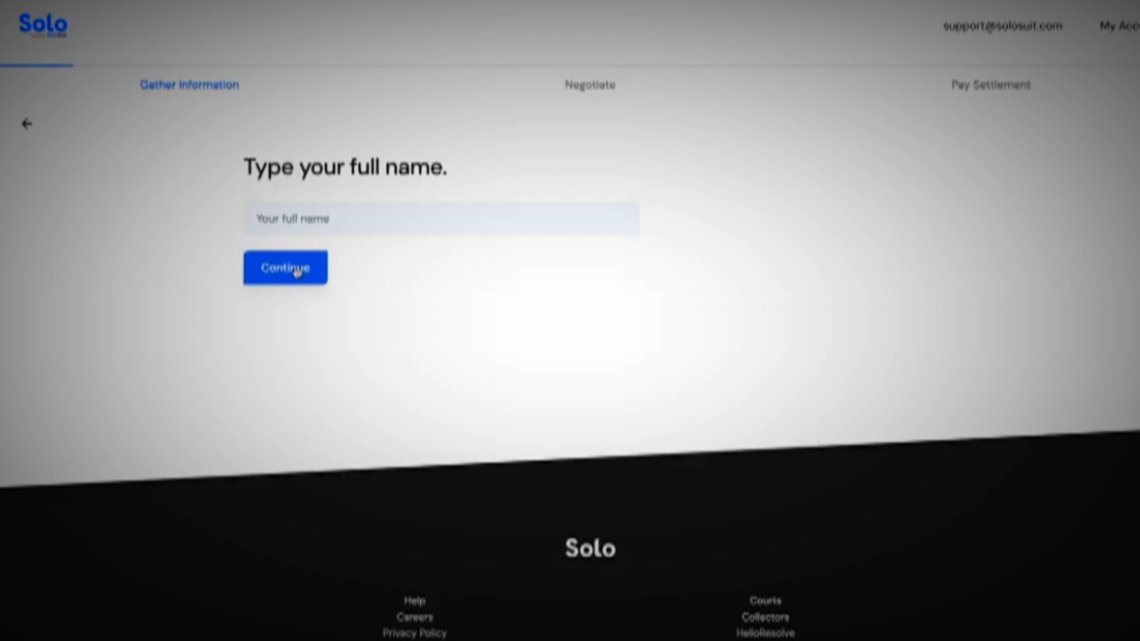

Solo, now expanded nationwide, has developed tools to help consumers not only respond to lawsuits but also negotiate with collection agencies. Users have reportedly managed over $1.5 billion in debt lawsuits through Solo’s platform, averaging settlements lower than the original claims, thus alleviating some financial pressure.

For consumers facing lawsuits, it’s crucial to act quickly. Ignoring a lawsuit can lead to unfavorable judgments. Community Legal Services offers free assistance for qualifying individuals needing legal aid. Alternatively, low-cost legal consultations are available through the “Modest Means Project” for those who do not qualify for free services.

Individuals seeking further information can find resources through the Consumer Financial Protection Bureau, which provides guidance on responding to debt collectors and understanding consumer rights. Ensuring informed and timely action can lead to better outcomes for those confronted by debt lawsuits.