Business

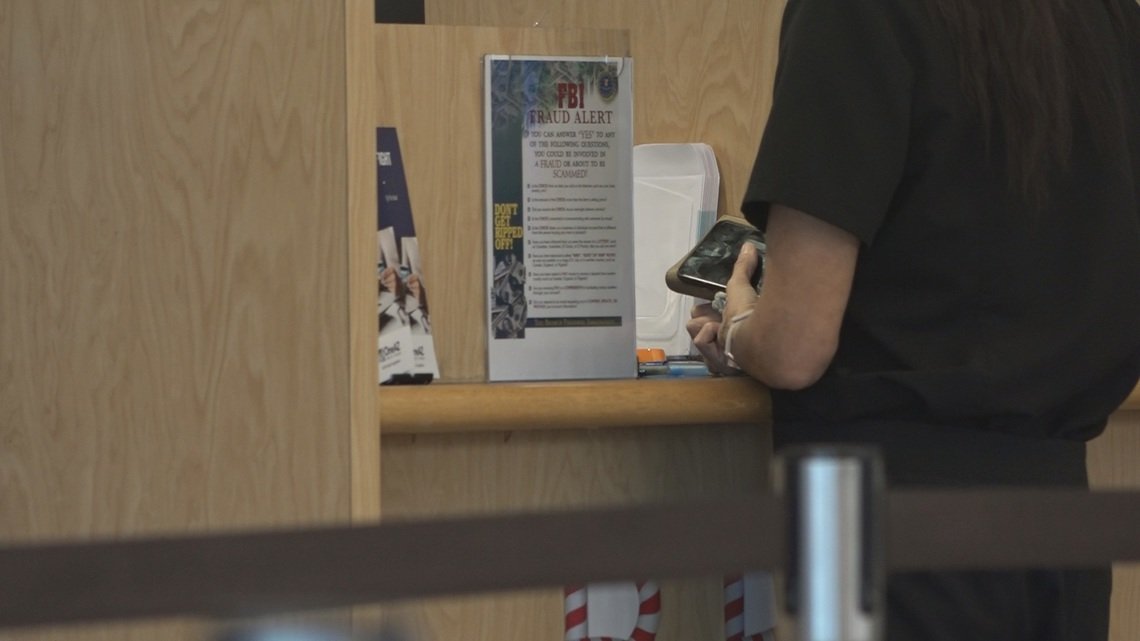

Tech Scams Empty Arizona Bank Accounts in Record Time, Officials Alert

PHOENIX — Arizonans face increasing threats from sophisticated text message scams that lead to identity theft and significant financial losses. Reports from OneAZ Credit Union indicate that victims are losing substantial amounts of money, with some cases reaching into the hundreds of thousands.

The scams often begin with urgent messages claiming account fraud. According to Laura Worzella, Chief Operating Officer at OneAZ, such tactics can ensnare anyone. “Anyone can be targeted by fraudulent texts about account fraud,” she warned. Scammers create a sense of urgency, convincing individuals they must act quickly to protect their personal and financial information.

Once victims engage, scammers frequently request sensitive details, including account numbers and passwords. Swift action is critical; once access is obtained, fraudsters quickly drain accounts. “They move fast. If you’re contacted immediately, a bank can often freeze accounts to prevent further losses,” Worzella added.

The trend extends beyond banking. The Better Business Bureau is also seeing a rise in romance scams, particularly as Valentine’s Day approaches. Reports suggest that victims may lose an average of $126,000 each, often initiated through social media or dating sites.

Experts outline several crucial points about the unfolding scam landscape in Arizona:

1. How the scams work: Fraudsters send alarming messages about account issues, targeting bank members. They request sensitive information, creating a false sense of urgency concerning debit card problems.

2. Warning signs: Be alert for fast friendships and immediate discussions about money, especially if the individual is abroad. “Not wanting a video chat is a major red flag,” noted BBB representative Joe Ducey.

3. Fast action needed: Prompt contact with banks can halt fraudulent transactions. The first 24 hours following a compromise are the most critical.

4. Money moves overseas: Scammers often transfer stolen funds internationally within hours, making recovery difficult once the money is gone.

5. National impact is growing: Text scams cost Americans $330 million in 2022, with bank fraud alerts ranking among the highest in reported incidents, according to the FTC.

6. Romance scams surge: Between February and March, victims reported losses totaling $885,000. These scams often involve perpetrators complimenting victims on social media before shifting the conversation to money needs.

7. Getting help: Victims should report incidents to local law enforcement and the Federal Trade Commission. The BBB offers an online scam tracker that outlines scams by zip code, helping individuals understand risks in their areas.