Business

Surprising Need: Flood Insurance in Arid Deserts!

The aftermath of Hurricanes Milton and Helene has left east coast homeowners grappling with immense challenges. Recent reports indicate that damages have soared to over $300 billion, with insurance only covering a paltry 5 to 10% of that total, according to CBS News.

Many affected individuals are embarking on their rebuilding journeys with little more than governmental support and community goodwill. In a related personal account, the author recalls a past emergency in 2017 when a monsoon flooded an investment property in east Casa Grande.

For an entire week, access to the home was impossible, surrounded by two feet of water. Upon finally entering, they discovered extensive mold due to the heat, leading to costly repairs. The bill amounted to $37,000, a figure that has since ballooned to an estimated $60,000 to $70,000, highlighting the rising costs of home repairs in flood scenarios.

This raises an important question: Is flood insurance necessary in a desert region? Ironically, flooding can be a significant risk. Approximately half of Maricopa’s neighborhoods contain properties within or adjacent to flood zones.

If your home is identified in a flood zone and you have a mortgage, flood insurance is likely a requirement. Conversely, cash buyers can opt out. Nonetheless, selling a property in a floodplain necessitates disclosure, which may deter potential buyers due to perceived costs, despite the generally low risk of flooding.

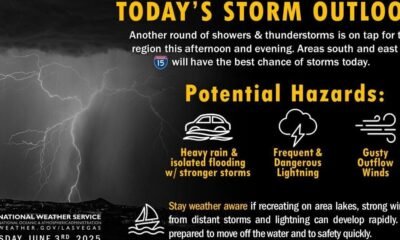

Homeowners can assess their flood risk by visiting the FEMA website and entering their address. The author, having learned from their own experience, opted for flood insurance on their current property, even though it lies outside a designated flood zone. Arizona’s unpredictable weather can pose unexpected threats.

Dayv Morgan, a local Realtor and owner of HomeSmart Premier, emphasizes the importance of being proactive about flood coverage in the region.